Proven protection for all your ATMs and SSTs.

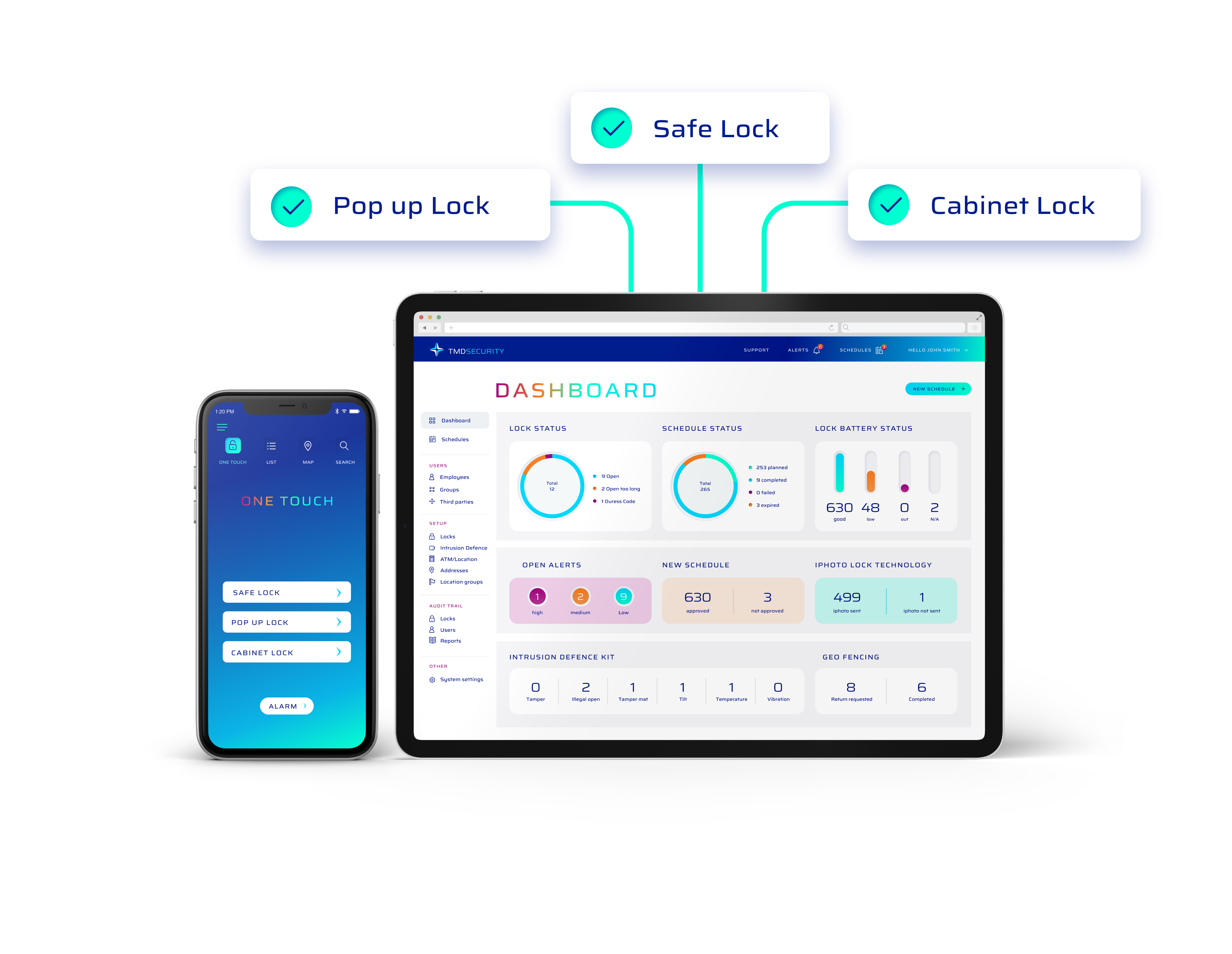

One key-less access solution with intelligent lock solutions for all access points.

Simpler, greener, more secure and most importantly, more efficient.

TMD R&D. Unique solutions you can trust.

We have been protecting ATMs all around the world for more than 20 years.

Unique, effective defence against solid explosives and gas attacks.

TMD’s shockwave technology proven to outperform all other defences.

Proven defence. TMD protects 400,000 ATMs and SSTs worldwide.

Defends against all types of attacks including deep insert skimming.

Unique, effective defence against solid explosives and gas attacks.

TMD’s shockwave technology proven to outperform all other defences.

Proven defence. TMD protects 400,000 ATMs and SSTs worldwide.

Defends against all types of attacks including deep insert skimming.

Active protection against jackpotting, including black box attacks.

Real-time access management with audit trail and alerts.

Proven defence. TMD protects 400,000 ATMs and SSTs worldwide.

Defends against all types of attacks including deep insert skimming.

We know how important the highest levels of security are.

Discover our solutions.

“TMD listens and responds to our requirements’’

“We trust TMD. They care about security as much as we do.”

“TMD knows that all the bank’s investment decisions need a business case. They helped us with a strong ROI.”